- Financial team recommended creating a captive insurance company.

- The pain practice partners created a domestic asset protection trust.

- The practice built an on-site laboratory and pharmacy.

- Financial advisors used various means to reduce taxes and costs, and to increase revenue.

Case Presentation

A Texas pain practice, run by three physician partners at three locations, employs about 50 people who care for approximately 2000 patients, and earns $16.5 million in gross annual revenue.

The senior partner in the firm engaged Michael Berry, ChFC, a financial advisor and member of the Special Advisory Board of MDalert.com. Mr. Berry and his team were hired in an effort to reduce unnecessary taxes, protect the assets and revenues of the firm and its partners, examine profitability and cost centers, evaluate revenue cycle billing and coding, reduce practice expenses, and fortify its estate planning, insurance planning, wealth management, and to potentially prepare the practice for sale.

Mr. Berry served as the chief financial officer (CFO)—the financial team leader—coordinating the input of a multispecialty team of expert advisors in tax law, insurance, profitability consulting, accounting, asset protection, estate planning, health care law, wealth management, and a number of other areas relevant to this practice.

Mr. Berry strongly advises that an investor appoint a CFO to organize the team of financial consultants. In this case, the team conducted a highly detailed evaluation of the practice business structure and found a number of areas where the practice could improve its position. It is important that all the information be integrated by one person who can share it with the investor.

Objectives

The specific objectives of this case were as follows:

- Evaluate the overall financial condition of the practice.

- Establish a target savings goal.

- Improve the overall investment and asset allocation position.

- Examine the retirement planning portfolio.

- Explore educational funding options.

- Reduce the company’s unnecessary tax burden and overall frictional cost of doing business.

- Evaluate insurance planning and products positions.

- Explore ways to reduce estate taxes.

- Devise an asset protection plan.

- Evaluate overall corporate plan and risk-management positions.

- Complete buy-sell agreements for the partners.

- Implement profitability consulting.

- Plan for philanthropy.

Methods

Mr. Berry’s firm takes an unusual approach to advising clients. “We specialize in process,” he said, “not products. In fact, our process is our product. What we offer foremost is a multispecialty portfolio of competence.”

The team with in-depth analyses of every aspect of the practice. “What we do is roll up our sleeves and get in there, complete our in-depth evaluation, and recommend a number of potential strategies and solutions,” Mr. Berry explained. “We then shop the marketplace for the best products for our client and ask each of those service providers to make presentations that describe the potential benefits to the client.”

Portfolio of Competence

Mr. Berry connected the client with a team of highly qualified advisors in every financial area that was appropriate to the practice and then asked each specialist to make recommendations within his or her specialty.

“If I ask a client ‘When was the last time your tax attorney, estate attorney, health care attorney, CPA, insurance agent, investment advisor, financial planner, operations manager, coding expert, practice administrator, liability agent all got into a room and discussed your situation?’ the answer I receive 100% of the time is never. The desired outcome is to reduce the randomness of prior decisions and link the relationships.

“Ninety-nine percent of the advisors whom I’ve met and 100% of our clients are unaware of all the tools that could be implemented, so the team approach is essential. Like medicine, the best financial care demands the expertise of diverse specialists to deliver a better outcome for the patient.

"The CFO serves as a team leader in order to coordinate all the moving parts, in order to reduce the randomness of the client’s decision making, and to act as an advocate for the client,” Mr. Berry explained. “I, as CFO, then sit on the client’s side of the table and ask the questions of the potential advisors that the client doesn’t know to ask.”

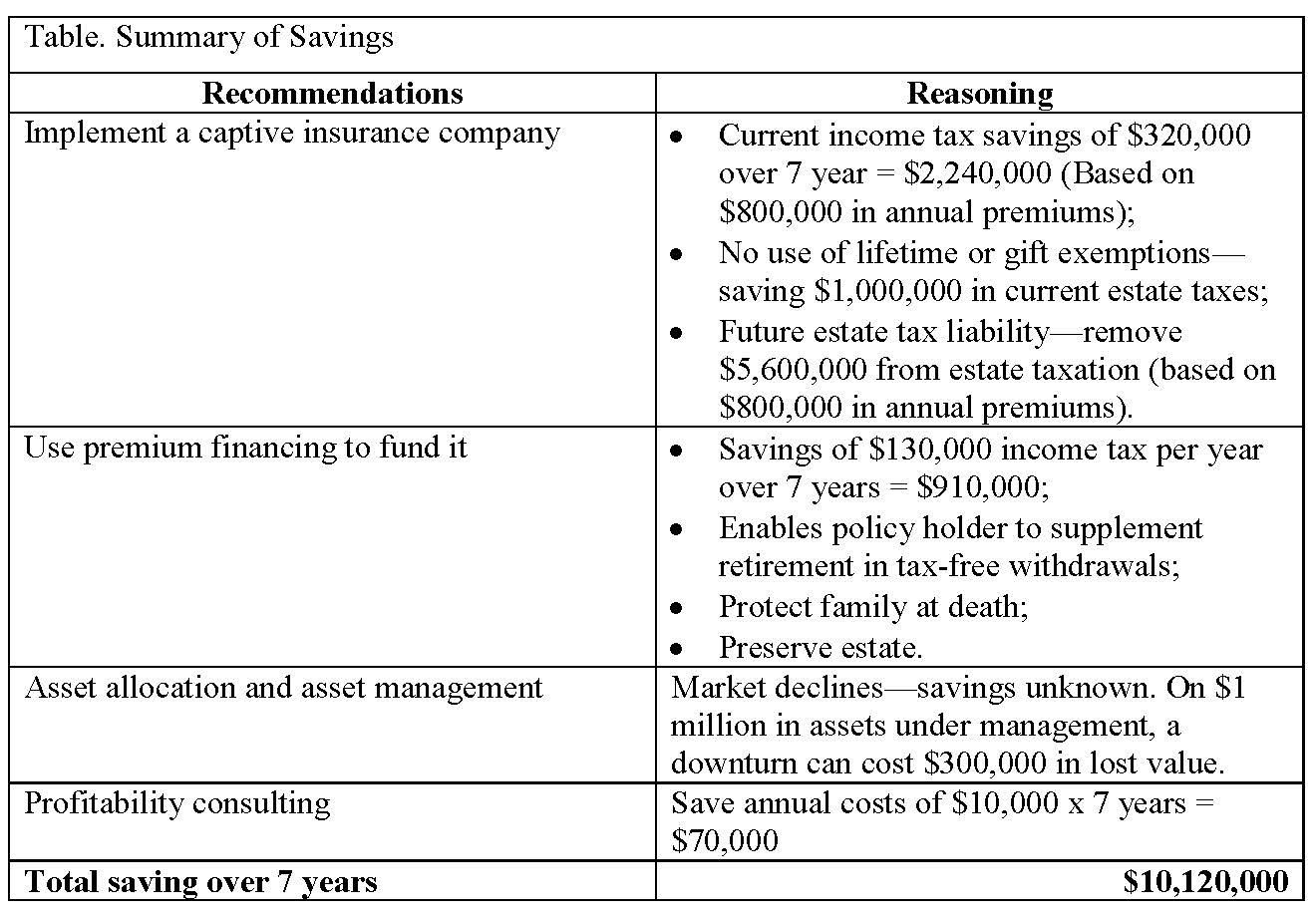

The results are decreased profitability leaks, reduced frictional costs, reduced tax burden, reduced randomness in financial and operational decisions, and increased revenue. These results can have two effects: They will likely increase the profit margin of the practice and will also make the practice more attractive to potential buyers. The net forecast savings to the senior partners over 7 years is approximately $10,000,000.

Recommended Actions

Create a Domestic Asset Protection Trust

In 1997, Alaska became the first state to adopt laws that allow a person to establish and fund a trust for his or her own benefit and have those assets protected from the claims of potential future creditors. Such a trust is referred to as a domestic asset protection trust (DAPTs).

An investor would set up a DAPT for her benefit and that of her family. She would specify what happens to the assets after her death and that of her spouse. If no specific election is made, the assets in the DAPT would be held in separate lifetime trusts for the benefit of the children or other beneficiary(ies).

The DAPT could own assets for the use and benefit of the trustee, such as a personal residence or second residence. It could also own interest in one or more LLCs. A CIC and could hold excess assets in a brokerage account. The goal of this type of asset protection and risk mitigation strategy is to provide flexibility, control, privacy, and efficiency while shielding assets.

Re-evaluate Corporate Structure

When evaluating corporate structure, the objectives are as follows:

- Maximize the tax efficiency of the structure.

- Minimize the difficulty of implementing.

- Insulate each ancillary and line of business from liability exposure and concerns.

- Increase business efficiency in order to prepare for potential sale of the practice.

- Create a domestic asset protection trust (DAPT) for the practice partners.

- Devise a buy-in/buy-out strategy in order to prepare for a partner to join or leave the practice.

- Implement buy/sell agreements that would be funded with life insurance in order to protect the practice and the remaining partner(s) in the case that one of the partners should die prematurely or become disabled and unable to practice medicine.

- Title all assets so that they are maximally asset protected (+5).

Target Savings

Mr. Berry emphasized in an interview with MDalert.com that it is crucial to set realistic, quantifiable savings targets for the client during the initial evaluation. (See Table.) For example, in the case of this Texas pain practice, it was clear that the team could reduce lab costs, but by how much?

Similarly, in the case of the practice’s qualified retirement plan (QRP), life insurance and disability insurance policies, could costs be reduced? If so, to what degree?

Realistic savings goals, with dollar figures attached, should be set in advance of the appropriate paperwork being assembled and coordinated.

Reduce the Cost of Doing Business

Any business, when examined closely enough by the appropriate professional, can find ways to save money. For instance, according to Mr. Berry, “We significantly reduced the frictional costs of this client’s credit card processing. We saved them about 47% in fees that they would normally have paid to another provider—$8,000 to $9,000 per year for swiping the same cards. We nearly paid for our fee right there. Even if we had done nothing else, we helped them.”

“These things literally have nothing to do with being a financial planner,” Mr. Berry pointed out. “We instead acted as a financial consultant for our client.”

Streamline Retirement Planning

Mr. Berry’s team examined the qualified retirement plan (QRP) run by the practice and found that there was very little participation among the employees, despite the significant contributions that the practice was making to the plan—about $1,500 per employee per year.

Mr. Berry asked, “Do you think your employees would find more value and appreciate you more if instead you gave each of them a $1,500 year-end bonus? What do you think has more mileage? The partners all thought that the bonus was a greater value in every way.”

Nonetheless, the partners clearly wanted their employees see the value in the company’s retirement plan. And, of course, the partners wanted feel that they were genuinely helping their employees with retirement. Upon investigation, the partners realized that the participants had not been sufficiently educated about the benefits of the program. “So, the first thing we wanted to provide them was better services on the QRP,” Mr. Berry noted.

During this examination the team also found that the program was costing the practice nearly twice the competitive rate in the marketplace. “We reduced the advisor fees by half for the same program. We did not change provider, who we felt was sufficient and strong in the marketplace,” he said. “But we did get the provider to start running regular virtual meetings with all the employees”

Take Steps to Protect Assets

In this approach, asset protection is folded into many other aspects of the overall strategy. For instance, the creation of a captive insurance company (CIC) serves the purpose of conserving assets that would otherwise be paid to a third-party insurance company and lost to the practice— while continuing to shelter the practice from risk. If the CIC is part of a properly structured trust, all the assets contained within it receive preferential tax treatment and are fully protected from creditors and litigation.

Additionally, the advisory team recommended annual contributions to 529 plans for the partners’ children. This recommendation serves three purposes:

- ) It removes these funds from the estate.

- ) It provides funds for college planning.

- ) It protects the assets from creditors.

Properly Structure Insurance Coverages: Form a Captive Insurance Company

A captive insurance company (CIC) is a domestic or foreign insurance company formed by a business owner to insure risks of the operating business. The owner of a business or a group of businesses can form a wholly owned CIC for the purpose of insuring his/her related companies. The insured businesses pay premiums to the CIC in exchange for insurance. The insurance premium paid is typically tax deductible by the business, and in the case of certain small captives, the premium income received by the CIC may be tax free.

A CIC can be owned by the business owner, spouse, relatives, a trust, or any other entity. The operating business pays premiums to the CIC, and the CIC insures some of the risks of the operating business. A CIC not only allows a business to control its insurance costs and ensure hassle-free payment when a claim is made, but also provides a highly tax-efficient method to accumulate wealth. Businesses can also use CICs to reduce the cost of insurance or improve the coverage at little to no cost. Often, the use of a CIC with a risk manager can greatly reduce the cost of the coverage and identify and insure gaps in coverage.

831(b) Captive Insurance Company. Generally, CICs are taxed on all income. However, the tax code permits property and casualty insurance companies to take certain deductions against taxable income, including premium income and investment income. These are not available to regular corporations.

As a result, a carefully administered property and casualty CIC may have little or no taxable income from premiums received. Code Sec. 831(b) provides a very powerful tax advantage for qualifying small CICs. If the CIC receives less than $1.2 million in premiums each year, it may elect to be taxed only on its investment income.

Thus, premiums are not taxable income to the CIC. Once the Code Sec. 831(b) election is made, it may not be revoked without prior written consent from the IRS. Fortunately, a Code Sec. 831(b) election does not alter the deductibility of premiums paid by the operating companies. The key advantage to making a Code Sec. 831(b) election is that the CIC is able to accumulate surplus from underwriting profits free of tax. Assuming the CIC carefully chooses its risks, it can accumulate significant assets in a fairly short period of time. “Given the fact pattern if this case, forming a CIC is an obvious strategy,” Mr. Berry explained.

Captive insurance companies are primarily designed to underwrite, distribute, and shift risk, assist with re-insurance, and to write policies on the practice and the physician partners. A formally structured CIC provides the client with a number of other advantages in addition to preferential tax treatment.

For example, the partners would be able to transfer up to $1.2 million per year from the practice into the CIC free of income tax and estate tax. If they wanted to include a CIC in their advanced financial planning, the plan could be structured to be owned by a generation-skipping trust or some other type of dynasty trust.

The CIC would offer the practice four major advantages:

- Risk shifting. The CIC shifted risk away from the partners and the practice and to the CIC. This is a service for which the client would normally have had to pay to a third party. The practice became able to write its own policies that covered all its ancillary risks, including death and disability.

- Income tax protection. The CIC saved the practice approximately $600,000 per year in income taxation.

- Estate tax protection. All the assets contained within the CIC at its formation and for the lifetime of the company are removed from the estates of the partners and so will be free of estate taxes.

- Asset protection and creditor protection. All assets contained within the CIC carry a +5 protection against creditors and litigators.

Other specific business and liability insurance recommendations made by Mr. Berry’s team included:

- Property insurance: The broker recommended a blanket policy rather than carrying individual policies on each of the seven practice locations.

- Increased levels of professional liability insurance to protect the practitioners;

- A general liability policy to protect the practice;

- An umbrella policy to further shift risk in cases where professional liability and employers liability policies were insufficient or did not fully shift risk away from the practice;

- An employment practices liability policy to protect the practice against potential employee claims.

Life Insurance Planning

Following an extensive examination of the practice, it became clear that one of the physicians was paying about $200,000 in annual premiums for a $6 million cash-value life insurance policy. Mr. Berry asked the physician if he recognized how much revenue he would have to earn in order generate and warehouse this asset ($200,000 per year). The answer is about $340,000.

“So we proposed a program called premium financing that allows the client to retain the $340,000 in annual revenue and invest it into the practice, invest it into a portfolio of assets, put it into the CIC, or whatever else he chose. And, he would maintain the $6 million in life insurance coverage,” Mr. Berry explained.

Profitability Planning

Before this practice engaged Mr. Berry’s firm, the partners had recognized that they would not be able to significantly increase the practice revenues simply by seeing more patients. Private, state, and federal reimbursements continue to decline, tax rates have increased and may well continue to do so, the costs of doing business and other expenses have increased, employee requirements have expanded, and simply caring for more patients cannot cover these costs and lost revenues.

The partners realized that if they were to substantially increase revenue, they would have to expand the ancillary services they offered, such as pharmacy and lab services. “So, they did the research with us,” explained Mr. Berry, “and implemented in-house pharmacies in each of their clinics. They also operate a clinical lab, so they don’t outsource the lab work any longer. Revenue that the practice had been paying to outside providers it now paid to itself.

Investment Planning and Asset Allocation

When Mr. Berry’s team began to evaluate the clients’ personal investment portfolios, it was determined that the clients were invested in expensive mutual funds and had purchased some funds and equities randomly throughout their lifetimes.

“We constructed a portfolio based on risk tolerance, time horizon, and tax efficiency, which is very important. Most clients don’t realize that the primary drag on a portfolio is not cost, it is taxes,” he explained.

“There are ways to re-evaluate investment portfolios and to use tax-efficient products to do so,” he added. “We then monitor and re-balance the portfolio as the client nears retirement.”

Through this process these clients became investment savvy enough that they were able to stop paying commissions to traders and to begin to execute the trades themselves, or to offer suggestions to investment advisors.

“The clients were very pleased that they now had a coherent investment strategy, and that they were able to do most of the investing themselves,” Mr. Berry explained. “The brokers they were using in the past charged a commission every time a trade was made. We connected them with Flagpole Capital, which is a fee-only provider. We found historical randomness in some of the financial decisions and sought to reduce this inefficiency by allowing the highly trained specialists to weigh in on the financial model and plan.”

This is common pattern among physician clients, Mr. Berry explained. As physicians become experienced, earn greater revenue, and increase wealth, they frequently purchase financial products without evaluating the effects of the purchase on other planning. “One of our aims is to reduce this randomness and to improve synergy among investments.”

The team recommended 3 distinct asset allocation strategies:

- A qualitative active manager approach using a multi-asset, multi-manager, multi-style approach based on Russell’s proprietary active manager selection process. These managers are uniquely qualified for security selection within the portfolio.

- A passive asset allocation approach using low-cost exchange traded funds and indices with periodic rebalancing. This strategy buys the market and is low cost.

- Sector rotation. This approach is often used by advisors with strong strategic views on where economy is headed. As economic conditions change, the portfolio is rotated into other sectors considered to likely outperform. Sectors not expected to perform well are under weighted or eliminated from the portfolio. This is a quantitative approach.

Some Things Stay the Same

Except in extreme cases, it is rare that every aspect of a practice’s finances would be overhauled, even after an in-depth evaluation such as this one. “It is not every time we engage a client that we are going to find something to repair or improve,” Mr. Berry noted. “If we are evaluating 10 topics, we might come back with recommendations on five of those. The other five we will double check and, in many cases, leave exactly as they are.”

In this case, the long-term care policies measured up to market benchmark quality, as did the practice disability policies. Mr. Berry’s insurance specialists ultimately recommended that the clients maintain these policies because they were of good quality and were competitive in the marketplace.

Use our "Ask Mike" feature if you'd like to pose a financial question to Mr. Berry.